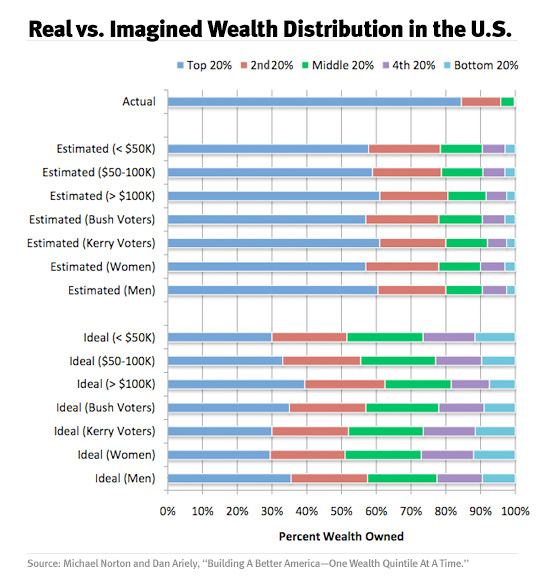

Wealth distribution in the US

This graph is telling. The rich? I think maybe they're rich enough.

From

this article.

I got a kick out of Ben Stein whining about the expiring tax cuts, on Sunday Morning. Whining about how after he pays his agent and taxes, he ends up with only 31% of his earnings.

1- the agent is a tax deduction.

2- much of the taxes he is paying, are property taxes on numerous multi-million dollar properties he owns.

No wonder he was a Nixon speech writer. :rolleyes:

Zero Liability Voters will always support income redistribution. As long as someone else is paying your way why should anyone care. The slate article only reinforces wealth envy and supports wealth redistribution.

Yeah, because it would be unfair to ask 20% of the population to pay 80% of the taxes just because they have 80% of the money. Riiiiight.

How old is that? Its comparing Bush and Kerry voters.

It doesn't matter how old, it only gets worse from there on.

Fresh Air

today. Robert Reich same subject...

Yeah, because it would be unfair to ask 20% of the population to pay 80% of the taxes just because they have 80% of the money. Riiiiight.

With so many extremists hyping myths, it becomes difficult to learn reality.

Taxes as a percentage of income increases as annual incomes increase to $250,000. Then something strange happens. As incoming increase further, the taxes drop dramatically.

Warren Buffet was quite blunt about this. He paid less taxes than his receptionist. And said so repeatedly including to Ted Koppel, live on Nightline. If you are a politician bought and paid for by certain people, then will say anything to avoid that reality.

Economies that have serious fundamental problems have most of their wealth in among the 2%. In America, such destructive wealth distribution has only existed once previously - just before the 1929 stock market crash. So much wealth among so few results in realties such as less job creation. Welcome to an economy advocated and achieved over the past decade. A problem that, ironically, America's richest people (Gates, Buffet, Turner, Soros, etc) have spoken out strongly against. Why would the richest of the rich speak about things against their own interests? Because this unequal wealth distribution is a serious part of America's problem - and is a source of massive campaign contributions to the most wacko extremists in government today.

Same people who wanted corporations to buy elections. Same people who took liberties with the Constitution to subvert American power to that advantage of the richest - at the expense of all others. Ironic. Those who complain about liberal judges are the same wacko extremist conservation who promoted liberal interpretation of the Constitution - to increase this unhealthy wealth distribution.

If taxable income is over--

But not over-- The tax is: $0 $7,825 10% of the amount over $0 $7,825 $31,850 $782.50 plus 15% of the amount over 7,825 $31,850 $77,100 $4,386.25 plus 25% of the amount over 31,850 $77,100 $160,850 $15,698.75 plus 28% of the amount over 77,100 $160,850 $349,700 $39,148.75 plus 33% of the amount over 160,850 $349,700 no limit $101,469.25 plus 35% of the amount over 349,700

Also some good discussion

hereI got a kick out of Ben Stein whining about the expiring tax cuts, on Sunday Morning. Whining about how after he pays his agent and taxes, he ends up with only 31% of his earnings.

1- the agent is a tax deduction.

2- much of the taxes he is paying, are property taxes on numerous multi-million dollar properties he owns.

No wonder he was a Nixon speech writer. :rolleyes:

Who should get the other 69% that

he earned, and what did they do to earn it?

It's just a simple

Pareto distribution.

Those are found all the time in nature.

They're organic.

Who should get the other 69% that he earned, and what did they do to earn it?

I should, but that ain't happening.

The various government entities he pays it to should, and do, get it.

I would guess 36%(after deductions, loopholes, and all the other taxes are deducted), plus SS, to the feds

Whatever the CA income tax is to the state.

10/15/20%? to his agent, which is deductible.

The rest to the communities where his real estate holdings are, just like you and myself.

Also some good discussion here

As I've said before, wealthier people pay less than their share of taxes. From class's link

But here's the weird part:[B] Everybody above the HENRYs in the income distribution faces a [B]lower effective tax rate too[/B][/B]. Somewhere in the top 1% (those making more than $410,000 in adjusted gross income as of 2007) things start to turn regressive. So if you make $20 million a year, you probably pay out a smaller percentage of your income in taxes than if you make $500,000. For a full, if somewhat dated, rundown of effective federal tax rates at the top end of the income distribution, check out this December 2008 report from the Congressional Budget Office (pdf!) A less complete but more up-to-date accounting is available from the Tax Foundation. State and local taxes have the effect of shifting the inflection point somewhat lower down the income scale — right into the heart of HENRYland.

One reason for this turn to the regressive is that the top federal income tax bracket of 35% kicks in at an adjusted gross income of $373,650, which is a lot of money but much farther down the income scale than the top brackets of decades past. There's been talk in Democratic circles of changing this and adding a new millionaires' tax bracket, but no evidence so far that the idea is really going anywhere.

Another oft-mentioned explanation for the fact that the rich pay lower taxes is that they can afford expensive tax lawyers, while a lot of the HENRYs use Turbotax. The biggest reason, though, is that as you get up into the dizzying heights of America's income distribution, you start encountering lots of people whose income comes mainly from investments. And investment income — dividends and capital gains — is taxed at lower rates than earned income.

There are some perfectly valid reasons for this: 1) dividend and capital gains taxes often amount to double taxation of the same income (taxed first as corporate income, then as shareholder income), 2) inflation erodes the real value of capital gains, 3) capital is mobile, so taxing it too much will send it scurrying abroad and 4) according to neoclassical economic theory (which is not infallible, but definitely worth paying some attention to), taxing capital retards economic growth.

The flip sides are that, 5) when capital tax rates are much lower than regular income tax rates, people in the highest tax brackets will find ways to transform their regular income into capital income (hi, all you private equity guys!) and 6) you get a tax system where people making $20 million a year shoulder less of the burden of financing government (relative to their incomes) than those making $500,000 a year.

I got a kick out of Ben Stein whining about the expiring tax cuts, on Sunday Morning. Whining about how after he pays his agent and taxes, he ends up with only 31% of his earnings.

1- the agent is a tax deduction.

2- much of the taxes he is paying, are property taxes on numerous multi-million dollar properties he owns.

No wonder he was a Nixon speech writer. :rolleyes:

I saw that too and all I could think was welcome to the country that made it possible for you to earn that much money. :rolleyes:

Zero Liability Voters will always support income redistribution. As long as someone else is paying your way why should anyone care. The slate article only reinforces wealth envy and supports wealth redistribution.

Yup. And wealthy fucks will always support their right to pay an insignificant drop from their ocean of wealth as taxes. As long as the rest of us are prepared to pay substantial chunks of our meagre earnings to keep the country running why would they care?

The slate article 'reinforces' wealth envy, but that envy is alreayd there to begin with, and frankly, I think that envy is justified. The obscene extremes of wealth and privelege that provoke that envy in the first place: that's unjustifiable.

I've got a pitch fork and a torch. I'm ready to rise up.

I've got a pitch fork and a torch. I'm ready to rise up.

Well now I know where my pitchfork went. Mr Gothic is very angry.

I'm not wealthy by any financial measure, but those who came from modest lives and earned their own wealth are the ones with the "do it yourself" attitude. The fuckers who inherited their wealth and/or have had it all their lives and know nothing other than that insane lifestyle have no clue about how the rest of us live.

The problem is the group that makes say $250,000 to $500,000. They are not in that insanely wealthy group. I don't thing its fair to lump them in with the multi-multi millionaires and billionaires.

This is just another reason for some type of tax reform.

$250,000 to $500,000 income or gross adjusted income?

for the sake of the argument - income

Bruce, do you only keep 36% of what you earn?

I wish I could keep 36% of my income, but since I'm not rich I have to use it to survive.

If you're still feeling sorry for poor Ben, he doesn't keep 36%, he pays 36%, and that's only on adjusted gross income after he invokes all the tricks and loopholes afforded the wealthy.

Why can't you get it though your fucking head everything he pays over that is his choice? The feds don't force him to pay an agent, but if he does it's deductible business expense. The feds don't force him to buy several multi-million properties, so he has to pay property taxes on them... at the same rate as everyone else in that town. The fed doesn't force him to buy lots of expensive shit, which incurs sales tax. Choices, rich people have lots of them.

Oh, lucky Ben. He gets to pay for his business expenses and his investments. I bet he even got to pay for his college loan. Why can't you get it thru your fucking head that it's his money, not yours, Obama's or anyone else's. When the government takes money or liberty from anyone, it is taking from us all. No wonder you can't keep enough for anything but expenses.

But spud, why is your tax money not yours then? Ben pays a lower percentage of taxes than you do. The question here is not "should we take money" from the rich or anyone else, it's "why do we take proportionally MORE money" from spudcon instead of Ben Stein?

I haven't had that proven to me. The original post was that Ben was whining about only being able to keep 31% of his income. I keep a larger percentage. The question still stands, What does someone else do for that 69%? I have no problem if he pays the same percentage as a person making less than him.

Oh, lucky Ben. He gets to pay for his business expenses and his investments.

Which are deductions, non taxed.

I bet he even got to pay for his college loan.

Uh, like everyone else?

Why can't you get it thru your fucking head that it's his money, not yours, Obama's or anyone else's. When the government takes money or liberty from anyone, it is taking from us all.

Yes they are, through a graduated system most feel is the fairest way, for the last hundred years.

Now what exactly are you bitching about? What do you want to happen? Do you want Ben to pay less than 36% (on part of his income), so you can pay more? A flat rate rather than graduated system?

Or do you want to do away with taxes entirely, don't let the government collect anything. What?

As far a Ben goes, he went on the air and whined about the feds, while totally lying through his teeth with misinformation and distorted numbers, in an attempt to make people feel sorry for him (and his rich buddies), and ultimately fool people into supporting a tax break for him.

He's a lousy actor and proved it Sunday morning.

Now if your real bitch, is where and how the government spends tax revenues, that's a whole different kettle of fish, and has nothing to do with whether they raise Ben's taxes 3% or not.

If starting tomorrow, the government could only spend money on things you approve of, they should still raise Ben's taxes 3%, because they still has to pay for that trillion dollar Iraq war, and 2 or 3 hundred billion for the savings&Loan fiasco, and 9 years in Afghanistan, and bailing out Wall street, and, and, and... plus interest.

I would love to see the graduated income tax and the IRS abolished. I wouldn't mind a flat tax, or a sales tax, as long as the said taxes weren't above 18%, and no other hidden taxes added to it. I would also like to see the Feds spending money on what they have the constitutional right to spend, and leave the states and the people to do the rest. But if it's 18% for you, it is only fair that it's 18% for everyone, millionaires, union workers, drug dealers, illegal aliens.

I would have loved to pay only 18%, it would have given me a huge raise over the years, but the states would have upped their taxes so I probably would have paid more. And much of that more would have been in property taxes that Ben feels are so unjust.

So you'd do away with Social Security, medicaid, medicare, and federal contributions to welfare, education and unemployment, first off. Then the Interstate Highway Fund, all those power dams, flood control projects, river & harbor dredging, and air traffic controllers.

Oh yes, and definitely OSHA, the EPA, FDA, and all of those busy bodies.

Boy we sure could make the country a great place to live without all that federal meddling. Yup, you'll be a lot healthier, if you put on your coonskin caps, and hunt your dinner.

C'mon Spud, we both know the federal government spends a ton on stupid shit, and wastes more than we can count, but your solution is a ridiculous over reaction, borne of frustration. It's not Obama's fault, nor was it Bush's. It's the dirty motherfuckers that we allow to run the government, the congress critters and the lobbyists/corporations. But replacing them with fools like Christine O'Donnell and Rand Paul, who have both sold out to Karl Rove, is stupid beyond belief.

The Republicans have promised small government and lower taxes, forever. But when they were in power, they did exactly the opposite... they lied.

The Democrats lied too, they're all liars. They promised more federal help to the states/people, and while they did give us a federal surplus, they immediately started bickering how they were going to spend it, instead of paying down debt and saving us interest.

They both give us more government, but the Republicans take care of the wealthy, and the Democrats do better by the rest of us. Either way smaller government is a pipe dream, we're not getting rid of them, so the best we can do is hold their feet to the fire, pressure them to do more good.

There was a poster recently, only made one post. He was collecting a huge government pension, I don't remember exactly how much. Well I checked him out on the net, as I do for all the new members I can. He was in two other forums trying to find out how he could screw his credit card company out of thirty odd thousand dollars, and get away with it.

The world is fucked up I tell ya, but don't throw out the baby with the bath water.

Bruce, I agree with you about Republicans and Democrats both being irresponsible jerks, but voting the good old boys out of office has to be a good thing. I'd rather have someone in office who has at least had a real job, or owned their own business than a career politician from any party. Those career pols have no idea about the real world.

I'd rather have someone in office who knows how the process works and is knowledgeable about laws. Who has gotten the education necessary to be a leader and write/read the bills that go through congress and be able to understand them at least fundamentally. Yes, I know they have staff for that, and realistically I understand that not all congress members can be 100% proficient in interpreting the laws. The biggest problem with our political system (as it is) is that only the wealthy can usually afford to run for office. I'd like to see that changed so that there are either limits on what can be spent to campaign or money for campaigning comes from a public fund that is evenly distributed. That is the real way to take control of our government from the wealthy, lobbyists and corporations. That makes the campaigners/politicians completely responsible to only the normal taxpayers and voters - us.

Bruce, I agree with you about Republicans and Democrats both being irresponsible jerks, but voting the good old boys out of office has to be a good thing.

Meet the new boss, same as the old boss.

I'd rather have someone in office who has at least had a real job, or owned their own business than a career politician from any party. Those career pols have no idea about the real world.

By the time a politician runs for a state-level office, he has sold his soul, and his idea about the real world is long gone.

I'd rather have someone in office who knows how the process works and is knowledgeable about laws. Who has gotten the education necessary to be a leader and write/read the bills that go through congress and be able to understand them at least fundamentally. Yes, I know they have staff for that, and realistically I understand that not all congress members can be 100% proficient in interpreting the laws. The biggest problem with our political system (as it is) is that only the wealthy can usually afford to run for office. I'd like to see that changed so that there are either limits on what can be spent to campaign or money for campaigning comes from a public fund that is evenly distributed. That is the real way to take control of our government from the wealthy, lobbyists and corporations. That makes the campaigners/politicians completely responsible to only the normal taxpayers and voters - us.

Unfortunately, the folks who would have to pass that legislation are very happy with the way things work now.:(

Unfortunately, the folks who would have to pass that legislation are very happy with the way things work now.:(

When I get rich spex, I'll run for office and change all of it. I promise!

Now, who wants to contribute to my campaign fund?

When I get rich spex, I'll run for office and change all of it. I promise!

Now, who wants to contribute to my campaign fund?

I have a spare pitchfork and torch for you to auction off at a golf fund raiser - just don't tell Shawnee where I you got them. ;)

The biggest problem with our political system (as it is) is that only the wealthy can usually afford to run for office. I'd like to see that changed so that there are either limits on what can be spent to campaign or money for campaigning comes from a public fund that is evenly distributed. That is the real way to take control of our government from the wealthy, lobbyists and corporations. That makes the campaigners/politicians completely responsible to only the normal taxpayers and voters - us.

I agree.

Unfortunately, the folks who would have to pass that legislation are very happy with the way things work now.:(

Unfortunately.

Unfortunately.

Don't agree with me. And stop stalking me. :ghost:

Meet the new boss, same as the old boss.

This is why third parties will never be the "solution" to our two party system. It all comes down to power. There are a lot of people who have stake in what the government does and will go to great extents to make sure a third party candidate won't take actions against their interests. So if a third party candidate gets elected they will either be useless because they are not all powerful, thankfully, and have almost everyone working against them or they will have to sell out and then becomes part of the current political system.

I'm just going to sell out a little bit, just enough to get some power, then I'll do really good shit, I promise.

Rand Paul has already sold out to Karl Rove, and he hasn't even been elected yet.

I'm just going to sell out a little bit, just enough to get some power, then I'll do really good shit, I promise.

I think a hell of a lot of politicians start out in their careers with good intentions. The machine of politics soon beats that out of them though :P

"I'm just going to sell out a little bit, just enough to get some power, then I'll do really good shit, I promise."

Quoting Nick Clegg at the Liberal Democrat conference earlier this year.

I would love to see the graduated income tax and the IRS abolished. I wouldn't mind a flat tax, or a sales tax, as long as the said taxes weren't above 18%, and no other hidden taxes added to it. I would also like to see the Feds spending money on what they have the constitutional right to spend, and leave the states and the people to do the rest. But if it's 18% for you, it is only fair that it's 18% for everyone, millionaires, union workers, drug dealers, illegal aliens.

:thumb: :thumb:

All you rich people say that... except Warren Buffet. :p:

Which are deductions, non taxed.

Uh, like everyone else?

Yes they are, through a graduated system most feel is the fairest way, for the last hundred years.

You mean

most as in the majority who support it but don't pay it.

As far a Ben goes, he went on the air and whined about the feds, while totally lying through his teeth with misinformation and distorted numbers, in an attempt to make people feel sorry for him (and his rich buddies), and ultimately fool people into supporting a tax break for him.

He's a lousy actor and proved it Sunday morning.

I don't think he won over any converts. He just sounded like a whiner. No one feels sorry for him, well except maybe the millionaires in Congress.

Now if your real bitch, is where and how the government spends tax revenues, that's a whole different kettle of fish, and has nothing to do with whether they raise Ben's taxes 3% or not.

If starting tomorrow, the government could only spend money on things you approve of, they should still raise Ben's taxes 3%, because they still has to pay for that trillion dollar Iraq war, and 2 or 3 hundred billion for the savings&Loan fiasco, and 9 years in Afghanistan, and bailing out Wall street, and, and, and... plus interest.

Hard to argue with that, we are in it deep. But that doesn't mean we can go on spending like whores with an openended check book and ignore those facts.

A flater tax makes everyone invested in the system. Do away with the loopholes. Hell start a VAT if that is what it takes, with some exceptions for food and income.

All you rich people say that... except Warren Buffet. :p:

Warren at least had the balls to stand up and say it, I'm guessing him and Ben are no longer friends.

Yup. And wealthy fucks will always support their right to pay an insignificant drop from their ocean of wealth as taxes. As long as the rest of us are prepared to pay substantial chunks of our meagre earnings to keep the country running why would they care?

The slate article 'reinforces' wealth envy, but that envy is alreayd there to begin with, and frankly, I think that envy is justified. The obscene extremes of wealth and privelege that provoke that envy in the first place: that's unjustifiable.

If everyone pays the same percent of income there is no substantial difference in the chunks of what you earned.

Oh, I see the TARP program looks like it will actually end up making a profit for the government. That's nice.

Last I heard they were going to be in the hole for 65 bil or something, the amount that was never going to be paid back.

That's not what I've been reading this week. Not all the alloted money was spent, so if you add what was left, to what's coming back, it will be at least even and more likely a profit.

That's not what I've been reading this week. Not all the alloted money was spent, so if you add what was left, to what's coming back, it will be at least even and more likely a profit.

So what happens to the money not spent? History tells us that Congress just sees it as another pot of money to redirect, rarely put back into paying down the deficit.

The money not spent and the money coming back, but that is beside the point.

Oh, I see the TARP program looks like it will actually end up making a profit for the government. That's nice.

George got lucky. . .

George got lucky. . .

George will get no credit.

Of course not. Nothing is ever blamed on or credited to (or even attributed to) the president. It's all the congresswhores isn't it? Depending on which side is doing what, right? I wish there were a flowchart as to who to blame and credit. I got lost with Clinton's zero deficit, lo those many years ago. :confused:

Of course not. Nothing is ever blamed on or credited to (or even attributed to) the president. It's all the congresswhores isn't it? Depending on which side is doing what, right? I wish there were a flowchart as to who to blame and credit. I got lost with Clinton's zero deficit, lo those many years ago. :confused:

I have stated all along that Congress is the bigger problem in this country. But of course it depends on which flow chart you want to believe. There are charts for Clinton too. :3eye:

I was pointing out a stream that runs both ways. Wade on in, the water's fine.

I think all the demoncrats that Rhammed this through should all get a bonus from whatever money is left. :haha: (I know he wasn't around then)

I don't know about that but it would not surprise me if they tried to redirect it toward pork projects.

See the :haha: smilie?

[SIZE="5"]

THAT WAS A JOKE![/SIZE]

THAT WAS A JOKE!

He is still having difficulty because TARP may have made a profit. It contradicts what extremist politicians have been preaching for years. A bridge loan called TARP may have literally saved the American economy ... and earned a profit. It may have been one of the better investments that Republican made. (So why did those same extremists blame the Democrats? Or will they now take credit for creating TARP?)

He is still having difficulty because TARP may have made a profit. It contradicts what extremist politicians have been preaching for years. A bridge loan called TARP may have literally saved the American economy ... and earned a profit. It may have been one of the better investments that Republican made. (So why did those same extremists blame the Democrats? Or will they now take credit for creating TARP?)

I was following Shaws lead (see congreeshores) and was channeling Themercenary. I believe even he thought it was funny.

Both parties passed the initial TARP. Virtually EVERYONE was on board at that time.

But you just go ahead an keep posting your unnecessary and unrelated partisan, extremist attacks. Its so new and refreshing. :scream:

Regarding humor or tongue-in-cheek: never follow my lead. It's not worked for me so far.

Both parties passed the initial TARP. Virtually EVERYONE was on board at that time.

But the republicans are blaming Obama for "the deficit caused by bailouts" in many political ads.

Regarding humor or tongue-in-cheek: never follow my lead. It's not worked for me so far.

Especially when you post your snarky bullshit comments to a humorous reply to one of your own posts.

Perhaps a "we were just kidding" tw would have been a better alternative than being a bitch. Just sayin'. <no smilie>

But the republicans are blaming Obama for "the deficit caused by bailouts" in many political ads.

Then they should grow a friggin pair and call the R's out on it.

However, I think they R's are referring to subsequent bailouts. Whatever works better for them - some things never change.

This explains it fairly well....

The irony in this drama is that the money at stake is, in the larger scheme, trivial. Raising taxes on the top 2% of households, as Mr Obama proposes, would bring in $34 billion next year: enough to cover nine days’ worth of the deficit. Indeed, the problem with the tax debate is not that Democrats and Republicans disagree, but that they mostly agree. Democrats think 98% of Americans should not pay higher taxes; the Republicans say 100% should not.

Taxes this year will come to less than 15% of GDP, the lowest share since 1950. The two reasons for this are the recession, which has left a diminished tax base, and the legacy of broad-based tax cuts in 1997, 2001, 2003 and 2009. Taxes are expected to rise to 19.6% of GDP in 2020 if all the tax cuts are extended; raising rates on the rich would lift the ratio to only 20% (see chart). That is nowhere near enough to pay for federal spending, estimated at 24% of GDP in 2020. “Citizens could be forgiven for forgetting that there is any connection between spending and taxes,” says Len Burman, a tax expert at Syracuse University.

http://www.economist.com/node/17043472?story_id=17043472&CFID=144836829&CFTOKEN=35979115I saw that too and all I could think was welcome to the country that made it possible for you to earn that much money. :rolleyes:

Yup. And wealthy fucks will always support their right to pay an insignificant drop from their ocean of wealth as taxes. As long as the rest of us are prepared to pay substantial chunks of our meagre earnings to keep the country running why would they care?

The slate article 'reinforces' wealth envy, but that envy is alreayd there to begin with, and frankly, I think that envy is justified. The obscene extremes of wealth and privelege that provoke that envy in the first place: that's unjustifiable.

___________________

When did DanaC become daviddwilson? (See post 15.)

When did DanaC become daviddwilson? (See post 15.)

:lol:

Why do people keep doing that? They sign up just to repeat a Dwellar's post? It's been happening off and on...very strange!

What that is --

The spammers are upping their game... tremendously. They have now reached the point where they attempt to resemble real people.

This one is from Vietnam.

Luckily, Miss Dana can never be duplicated: she's one of a kind, and she doesn't spam us. :)

O'DONNELL: But what I'm proposing is to give these tax -- to make sure that the tax cults for our Delawareans do not expire this January. You have said that you will stop the tax cuts for the so-called rich. What you fail to realize is the so-called rich are the small business owner, the dry-cleaner down the street, the pizza shop owner who makes $300,000 before they pay their four employees, before they feed their own family...

The tax on a proprietorship or partnership is calculated

after expenses are deducted. Is she lying, stupid, or both?

That's the result of being coached in rhetoric, without understanding the reasoning. It's easy to be wrong, but she can do it with a straight face.

The tax on a proprietorship or partnership is calculated after expenses are deducted. Is she lying, stupid, or both?

Not to mention that even if that was all taxable income, they would only be paying the pre-Bush rate on $50,000 of it.

Is she lying, stupid, or both?

Both. There is no doubt. I don't think she even cares if she wins. She gonna make a mint off the notoriety. Heck she'll probably be a Faux analyst by Christmas.

That's the result of being coached in rhetoric, without understanding the reasoning. It's easy to be wrong, but she can do it with a straight face.

That is the purpose and point. Many will believe her only due to presentation. Many will simply ignore that facts and numbers. She looks honest. Therefore she must be telling the truth.

Christian Colleges require courses that teach how to 'present'. How to move facial features makes some people 'appear' to be honest. Presentation rather than facts are only important to those most easily manipulated by lies.

Why was George Jr so successful? He entered a town, remembered everyone's name, and appeared to be so honest. He was a master of 'presentation'. And was a mental midget. George Jr was the perfect front man. So is Palin. And so is O'Donnell. Many only see the presentation – then believe what they are told to believe.

So many only 'feel' what is true rather than 'learn' what is true. 'Presentation' rather than 'knowledge or honesty' is important. Even explains why 4,400 Americans were killed in Iraq for no purpose.

Christian Colleges require courses that teach how to 'present'.

Huh? You mean like a public speaking class?

Huh? You mean like a public speaking class?

More than public speaking classes. Students are video taped to learn facial expressions; how to move eyebrows and how to manipulate the music of a voice. To learn how to raise, lower, and present words. It is not about content and logic. It is all about presentation. How to spin a feeling.

A listener can judge based upon two criteria. The first is to ignore the presentation; instead listen for facts. Second is to listens only for a feeling. O'Donnell (as did George Jr) is completely about the presentation. She is superb. Simply memorize canned expressions and illogical soundbytes. Her soothing presentation means those 'second listeners' know she must be honest. They 'feel' the presentation; ignore the facts. And it works.

It was, for example, how so many knew you smoke cigarettes to be healthier. Or knew cough drops cure a common cold. Or bought GM cars even though doing so put Americans out of work and cost more money after the purchase. Image. Presentation. Facts be damned.

Some of the best presentations were caustic, crude, annoying, and right on the money. Some people knew it was wrong only because they 'felt'. Others saw reality by ignoring 'feelings' and other irrelevant emotions. It says why some so love O'Donnell and why others see her as a facade. When it comes to presentation, she is a master. As was George Jr.

Anyone who discounts O'Donnell because her appeal is superficial is ignoring why so many judge and vote as they do.

What "Christian Colleges"?

O'Donnell is completely about the presentation. She is superb.

Superb at what? Shes an idiot and she sounds and looks like one when speaking.

Which Christian college did you attend?

I am rather sure that most colleges, christian or otherwise teach classes like that as well.

More than public speaking classes. Students are video taped to learn facial expressions; how to move eyebrows and how to manipulate the music of a voice. To learn how to raise, lower, and present words. It is not about content and logic. It is all about presentation. How to spin a feeling.

Cite.

TW used to call himself a professor. I'm just asking him for the minimum due diligence for his frothy whipped bullshit, as any good academic would.

TW used to call himself a professor. I'm just asking him for the minimum due diligence for his frothy whipped bullshit, as any good academic would.

60 Minutes (I believe it was) reported on what is taught in these colleges about 10 years ago. They showed students being videotaped. Then analyzed for how their facial muscles must move to make themselves appear to be more honest. I believe the concept was called kinesis.

O'Donnell demonstrates characteristics of one carefully trained in same. Do not know if she receieved such training. But what she does well is presentation. How to appear honest. As I believe classicman notes, the words and concepts behind her presentation are empty. She is all about image. And that, unfortunately is enough for many to believe her. Image alone was sufficient for O'Donnell to defeat a long time, popular, and highly regarded Republican Congressman from Delaware.

I never called myself professor. Would not even consider such a title. And have no idea where that idea even came from.

A ten year old 60 minute show about some college, does not warrant the blanket statement, "Christian Colleges".

Agreed. Besides didn't she go to Hogwarts?

I never called myself professor. Would not even consider such a title. And have no idea where that idea even came from.

I think I do. One of the default user titles is "Professor" 365-399 posts. If you were using the default title in that period...

... but he played one on the web.

And stayed at Holliday Inn Express.;)

60 Minutes (I believe it was) reported on what is taught in these colleges about 10 years ago. They showed students being videotaped. Then analyzed for how their facial muscles must move to make themselves appear to be more honest. I believe the concept was called kinesis.

I believe you are referring to a piece that was about schools for those who wished to become televangelists such as Jimmy Swaggart, Jim Bakker, Jerry Falwell, Oral Roberts and the famous Joel Osteen. Thats a big difference than just a Christian College.

O'Donnell demonstrates characteristics of one carefully trained in same. Do not know if she receieved such training. But what she does well is presentation.

She's cute and "perky" (like a mini-Palin.) but thats about it. Not to many. Her presentation sounds immature, uninformed and shallow. She has ZERO substance.

A change from what we got in 2008. Interesting how "hope & change" has morphed into something as ridiculous as this.

Image alone was sufficient for O'Donnell to defeat a long time, popular, and highly regarded Republican Congressman from Delaware.

Not as popular as one would have believed, apparently. Then again, perhaps complacency took over. Perhaps that apathy led to this situation.

I listenend to her debate Coons this am on the radio.

OMFG - First off, she doesn't know which amendments are which and then she asked where in the constitution was the part about separation of church and state. I had to turn it off.

I strongly dislike Coons opinions, but I'd put yard signs up for him at this point - just to ensure she doesn't win. This woman is beyond pathetic. Its truly sad that the choices to elect our representatives have come to this.

I think I do. One of the default user titles is "Professor" 365-399 posts. If you were using the default title in that period...

Ah. I did not know that. It fit so well with TW's tone that I assumed it was his choice.

Did tw really have less than 400 posts in February 2003?

By looking at his join date and total posts, I see that tw has about a half a post per day average. So, yeah that seems likely.